Commentary By Gary Kopycinski

Editor & Publisher – ENEWSPF

The property tax blame game has started again. I have heard the arguments begin to foment again.

The song of the blame game is the same. Blame village staff for the small business base in Park Forest. We are not business-friendly, right? Or blame the co-ops. They don’t pay as much as homeowners pay. So until we get our business base back, we must see that the five housing cooperatives pay more taxes so that the homeowners will pay less!

The finger-pointing stops there, however. We don’t talk about the regressive property tax system in Illinois. Cook County is the only county in Illinois where businesses pay roughly twice what homeowners pay in taxes. In Park Forest, a town with a business base still in recovery, this means fledgling and long-standing business enterprises end up with absurdly high tax bills.

None of us want to pay high taxes. A recent Brookings Institution study has shown the property tax system nationwide is incredibly unfair to African Americans and other marginalized groups. That’s indicated by what we see in the South Suburbs, especially in the four contiguous townships of Bloom, Bremen, Rich, and Thornton.

The Blame Game: Soak the Co-ops

Some argue the co-ops don’t pay enough taxes, so we should soak the co-ops. Homeowners, after all, pay $4000-$12000 for far less land. Some in town, including some in Village Hall who should know better, see courtyards in the housing cooperatives and argue co-ops should be taxed on the land, not the price of shares they pay to purchase a unit.

There are those in Park Forest who want to “fix” the system by changing the designation of the co-ops and how they are assessed individually. They want to toss them in with apartment complexes. They’ve given up on Springfield ever doing what needs to be done: gut the property tax system and shift school taxes to income taxes. They’ve given up, or they don’t get how wrong the property tax system is for everyone.

Some cooperatives in Chicago sell at a higher price, paying higher taxes than our co-ops pay. However, their taxes are still based on the price of a share.

Cooperative units in Chicago sell for more than ours do. But they still only pay property taxes based on the price of their share transactions.

But look how much Pangea sold for!

Some argue that cooperative members should pay higher taxes because the Pangea Park Townhomes in Park Forest recently sold for over $35 million. A department head in the Village of Park Forest is making this argument.

However, Pangea apartments are part of a for-profit corporation owned by a person or persons who are in the business of making money. Renters there pay as much as $1750 per month to live there. The business of the corporation is to make money for the owners.

Because of the large amount of money the Pangea property recently sold, the Cook County Assessor’s Office increased the assessments of Park Forest’s cooperatives. One of the cooperatives saw a 72% spike in their evaluation. This is absurd. Pangea is for-profit. The cooperatives are not.

Homeowners Also Saw a Hike in Evaluations

Single-family property owners also saw a sharp increase in their evaluations. Much of this current increase was based on the selling prices generated from revenue for speculators who purchased the homes when they were at rock bottom value. Some of these properties were even tax delinquent or in foreclosure. These speculators made some basic improvements and now have sold them for far above what they paid initially.

These speculators made money off of Park Forest housing and went on their merry way. It’s the homeowners left in the Village — who have no desire to sell their homes and thus benefit from the increased value — who will be forced to foot the bill for increased taxes.

This shows how the current property tax system is unfair to everyone, not just co-op residents. It’s a different type of problem, but still illustrative of the problem with the system.

Cooperatives Are “Not-for-Profit” Entities

Often, the blame game targets the cooperatives. The five housing cooperatives in Park Forest are not-for-profit corporations. These corporations require monthly carrying charges from their members, not rent. The corporations themselves make no money. The carrying charges are for operations and capital expenses. Cooperative members do not make a profit from their cooperative corporations. Members see no money because they own their cooperatives or, rather, one share of their cooperatives.

Cooperative members don’t benefit from high selling prices that equal the value of their cooperatively owned land. They do not sell their common areas. They don’t even sell the ground outside their front and rear doors. They only sell what’s inside their walls and the improvements they made to their units.

Thus, while a homeowner might sell a house on Tamarack Street for $350,000, cooperative units go, at best now, for $45,000.

But if they sold the whole cooperative, they’d rake it in!

What would happen if members of a cooperative sold their entire cooperative to a for-profit corporation? Wouldn’t they rake in millions? Wouldn’t they all be rich?

What if the members of Ash Street Cooperative sold all their buildings and land for $4 million? Make it $5 million! If all units were occupied, roughly 285 members would each see a windfall of $17,544 minus taxes. Make the selling price $10 million and do the math. (Note: Ash Street Cooperative is not nearly as large as Pangea.)

After the sale, cooperative members would now pay at least twice what they currently pay to whatever corporation or LLC snapped up their land.

And the property tax system in Illinois would still be broken. People would still lose their homes, apartments, or businesses from a regressive and unfair taxing system.

Stop the Blame Game: We All Must Work Together

Homeowners typically see an excess of $150,000 when they sell their homes. Cooperative members see far less when they sell their shares. Homeowners pay higher taxes now, but they do have the benefit of the equity they have amassed in their homes.

But we know that equity doesn’t matter if people must leave homes they like because of property taxes.

Again, this is small solace if you’re taxed out of your home. Or your apartment, your business, or your cooperative.

Again, School Taxes Are Unfair

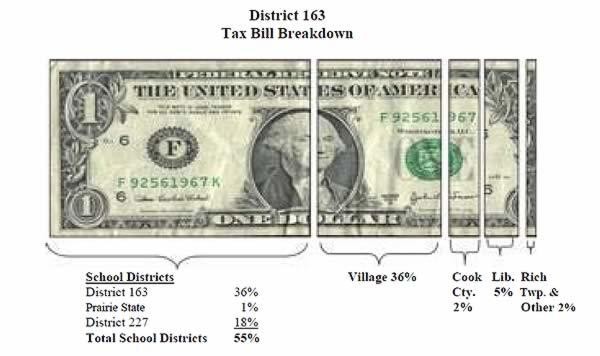

All of us pay a huge chunk of our taxes to the schools. We’ve known this for years. It’s horrible and unfair. But Chicago and downstate towns don’t see the same issues that we do in Park Forest. They don’t get it. Their cooperatives are dwarfed by thousands and thousands of homes, apartments, and business after business after business.

Our business base is slowly growing, but it’s still not nearly high enough to offset residential property taxes like it did decades ago. Back then, residents repeatedly voted to give one school district more and more money. Voters in Park Forest-Chicago Heights School District 163 went all in for their children. They never imagined that Park Forest would lose its business base to Matteson and then the western and northern ‘burbs.

Don’t Blame the Schools

Illinois must gut its property tax system. School taxes MUST migrate to an income tax. It’s the only fair way to raise tax dollars. Property taxes are unfair. People lose their homes. Businesses dissolve, losing the ability to meet operating costs. This is especially true in Cook County with the damn “property tax equalization factor,” now at 2.9237 as of September 5, 2023. That drives businesses away from struggling communities like Park Forest and many other southern ‘burbs.

So sad.

Years ago, I went to a rally for the re-election of then-Gov. Rod Blagojevich. Yes, blame me in part. I told him, “Governor, please help us with our property taxes. We’re sinking here.” He chuckled smugly and said, “Yeah.” Then he walked away.

Springfield has a behind-the-scenes reputation of being a party town for legislators. Maybe they should “out” each other and get to work for the people. Do the hard work and gut the property tax system.

The writer is the Editor and Publisher of this publication, eNews Park Forest. He has lived in Ash Street Cooperative since August 2000. He was a member of the Village Board from 2003-2015 (minus one year), and currently serves on the Ash Street Board of Directors as Vice-President.