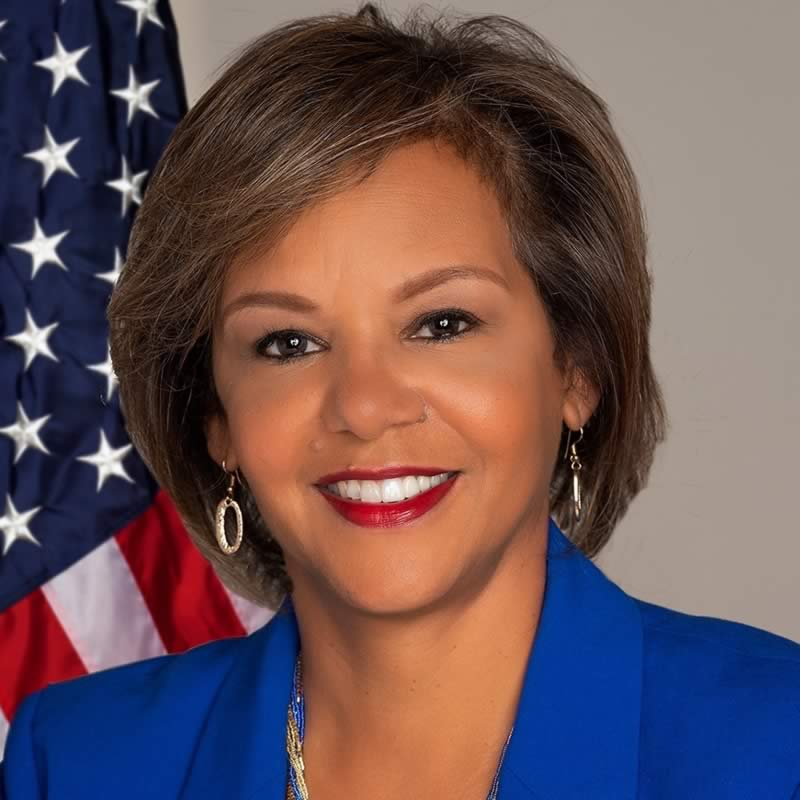

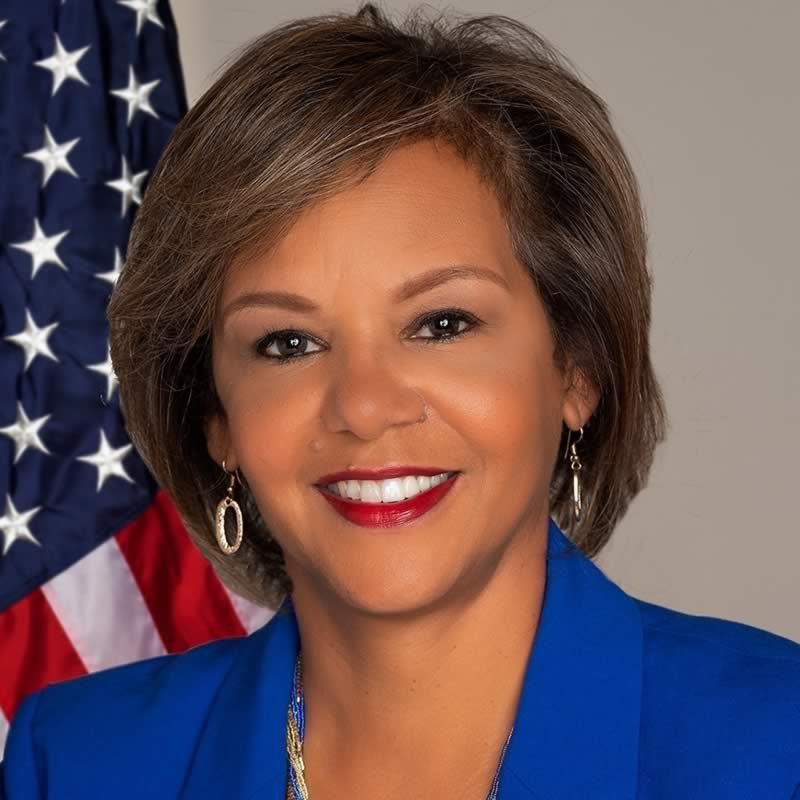

Washington, D.C.-(ENEWSPF)- Congresswoman Robin Kelly released this statement in December following her “YES” vote on the Restoring Tax Fairness for States and Localities Act (H.R. 5377), which will reduce the federal tax burden on Illinois homeowners created by what she calls the “GOP Tax Scam”:

“When Congressional Republicans rammed through their GOP Tax Scam, they raised taxes on Illinois homeowners by needlessly capping the state and local tax (SALT) deduction at $10,000 per year.

“The imposition of this cap resulted in higher federal taxes on homeowners in Illinois and other so-called “blue” states which tend to have higher state and local taxes.

“Since the passage of the GOP Tax Scam, American families have come out strongly against this provision and the law generally. Much of the opposition is rooted in the simple fact that the bill gave more than 80 percent of the benefits to a small, handful of super-rich American families while middle and working-class families in Illinois and around the country were left paying the bill.

“This legislation, approved today, doubles the allowed SALT deduction and is a first step toward correcting the problems created by the GOP Tax Scam, a partisan bill that raised taxes of many working and middle-class Illinois families.

“House Democrats are focusing on kitchen table issues that matter to Illinois families. Passage of this bill, along with our efforts to reduce the cost of prescription drugs, address gun violence and raise the minimum wage, is House Democrats delivering on our For The People promise.”

This is from a statement by Congresswoman Robin Kelly’s office.