N.B. This article was edited on November 30. 2016, at 4:54 p.m. to reflect that the overall actual tax levy increase is 2.2%.

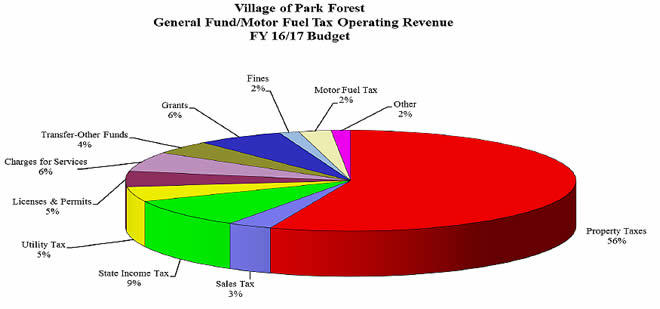

Park Forest, IL-(ENEWSPF)- Monday evening’s meeting of the village board saw first reading of the proposed 2016-2017 tax levy increase. If the levy passes, which is likely, Park Foresters will see a 2.2% hike in taxes for the next fiscal year. Fifty-six percent of the proposed General Fund operating revenue will come from property taxes. Contrast that with the FY 2006-07 and FY 2007-08 budgets when the operating revenue for the General Fund was funded 46% from property taxes.

The Village of Park Forest is seeking a 2.9% tax levy increase. However, the Park Forest Library‘s increase actually has a net effect on the overall levy of -0.7%, leaving a tax levy increase of 2.2%.

“The Village’s increase is 2.9% over the 2015 extended levy,” Finance Director Mary Dankowski told eNews Park Forest. “But the Library is actually levying the same as their original levy, which is actually a reduction over the extended levy. So, 2.2% represents the net of the Village’s increase plus the Library’s decrease, in effect, because they’re levying what they originally levied, rather than taking into account the extension with the loss factors that [Cook] County adds to it. So, the Library having a lesser levy than the extended causes the extended levy to be less than what the Village’s is. So, the 0.7% reduction relates to the Library.”

A public hearing for the tax levy is scheduled for the beginning of the village board’s first meeting in December, Monday, December 5, at 7:00 p.m. The final levy is scheduled to be adopted at the regular meeting of December 12.

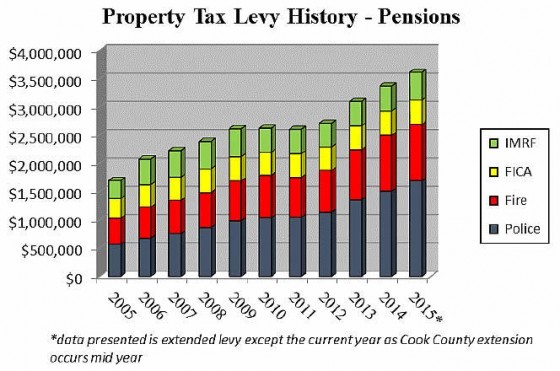

This year’s increases are “entirely due to pensions,” according to Finance Director Mary Dankowski. Pensions have gone up dramatically over the past decade. In 2005, the Village share of pensions topped $1.5 million. For 2015, they top $3.5 million, a 233+% increase. The police and fire departments are responsible for more than 2/3 of the total, with police claiming the lion share.

More details from a November 28, 2016 memo from Mary Dankowski to the village board:

The property tax levy for general corporate purposes funds the general operations of the Village – Police, Fire, Administration, Public Works, Recreation and Parks, Health, Community Development and Economic Development – which are not funded by other sources. As can be seen in the pie chart [above], the 2015 levy supported 56% of the total operating budget.

“Revenues have not always kept pace with expenditures,” Dankowski continued.

Expenditure increases are factored in the property tax levy needs. When developing the levy, other revenue sources are also evaluated. Use of fund balance has previously allowed the Village to maintain a 3.4% or lower property tax increase for fourteen of the last seventeen years.

Salaries and benefits are, by far, the largest expense for the Village.

For Fiscal 2017, personnel received a 2.5% salary increase, including police and fire. The dollar increase presented in the proposed levy assumes a 2.5% annual salary increase for all Village personnel, consistent with the Fire contract, and a 2% increase in other operating expenditures. After three years of no operating expense increase for departments, a 2% increase was allowed for Fiscal 2012 through Fiscal 2016 to accommodate increasing cost of operations.

The net result of levy needs and the use of General Fund balance on the general corporate property tax base is as follows, the memo continues:

2016 Tax Levy

GENERAL CORPORATE

| Salaries 2.5% | $400,000 |

| Health Insurance 10% | 200,000 |

| Other Expenditures 2%* | 190,000 |

| Additional Funds Needed for Operations | 790,000 |

| Utilize Portion of Fund Balance over 3 months reserve: ** | (790,000) |

| Tax Levy Needs | $0 |

* Other expenditures include capital outlays, utilities, postage, legal, etc.

** Utilizing $790,000 of fund balance leaves a 3.4 month reserve.

The Village will see a decrease of $685 in the proposed levy for bonds and interest, due, in no small part, from the ability of the Village to abate $900,000 in TIF debt. “In addition, the General Fund debt in the Bond Retirement Fund is in a position to abate $45,000 in debt service,” the memo continues. With that $900,000, $45,000 from the General Fund, and $88,966 from the Water Fund, the Village is able to abate a total of $1,033,966 in the bond and interest levy, according to the memo.

By abating these total taxes, the Village saves residents what would be an addition 7% on the tax levy, according to the memo.

LEVY SUMMARY

| Original | Extended | Proposed |

| 2015 Levy | 2015 Levy | 2016 Levy |

|

$10,961,576 |

$11,266,160 |

$11,266,160 |

|

435,494 |

454,910 |

454,225 |

|

491,600 |

505,150 |

590,150 |

|

430,531 |

442,525 |

462,525 |

|

1,689,415 |

1,735,910 |

1,904,411 |

|

999,214 |

1,027,025 |

1,201,675 |

|

$15,007,830 |

$15,431,680 |

$ 15,879,146 |

|

2,102,087 |

2,160,816 |

2,102,087 |

|

$ 17,109,917 |

$ 17,592,496 |

$ 17,981,233 |

| Increase over Extended Levy: 2.2% | ||

Adding the 0% increase from the Library’s 2015 levy, the total proposed levy forFY 2016-2017 is 2.2%.

Again, the public hearing for the tax levy is scheduled for the beginning of the village board’s first meeting in December, Monday, December 5, at 7:00 p.m.